With fintech giants like Robinhood and GoTyme Bank expanding crypto services in Southeast Asia, launching a compliant crypto trading platform in emerging markets like Indonesia and the Philippines has never been more timely—or more challenging. This guide walks you through the exact steps to get started.

Step 1: Understand Local Regulatory Requirements

Before writing a single line of code or partnering with a crypto exchange, you need to grasp the regulatory landscape in your target market.

Here’s how:

- Indonesia: All crypto trading must be licensed through Bappebti. A good example is Robinhood’s acquisition of PT Pedagang Aset Kripto.

- Philippines: Crypto services must operate under BSP and SEC rules. GoTyme partnered with Alpaca to meet these regulations.

*Action Tip:* Contact a local fintech law firm or consultant to fast-track your compliance checklist.*

Step 2: Choose a Licensed Crypto Liquidity Partner

You don’t need to become a full exchange to offer crypto trading. Partnering with a licensed API-driven broker or liquidity provider is faster and scalable.

Popular options include:

- Alpaca – Used by GoTyme Bank for crypto integrations.

- Fireblocks – Offers enterprise crypto custody and liquidity aggregation.

- Binance Institutional – Now licensed in Abu Dhabi, suitable for UAE or global expansion.

Make sure your partner has regulatory approval in your operating country or frameworks to help you comply.

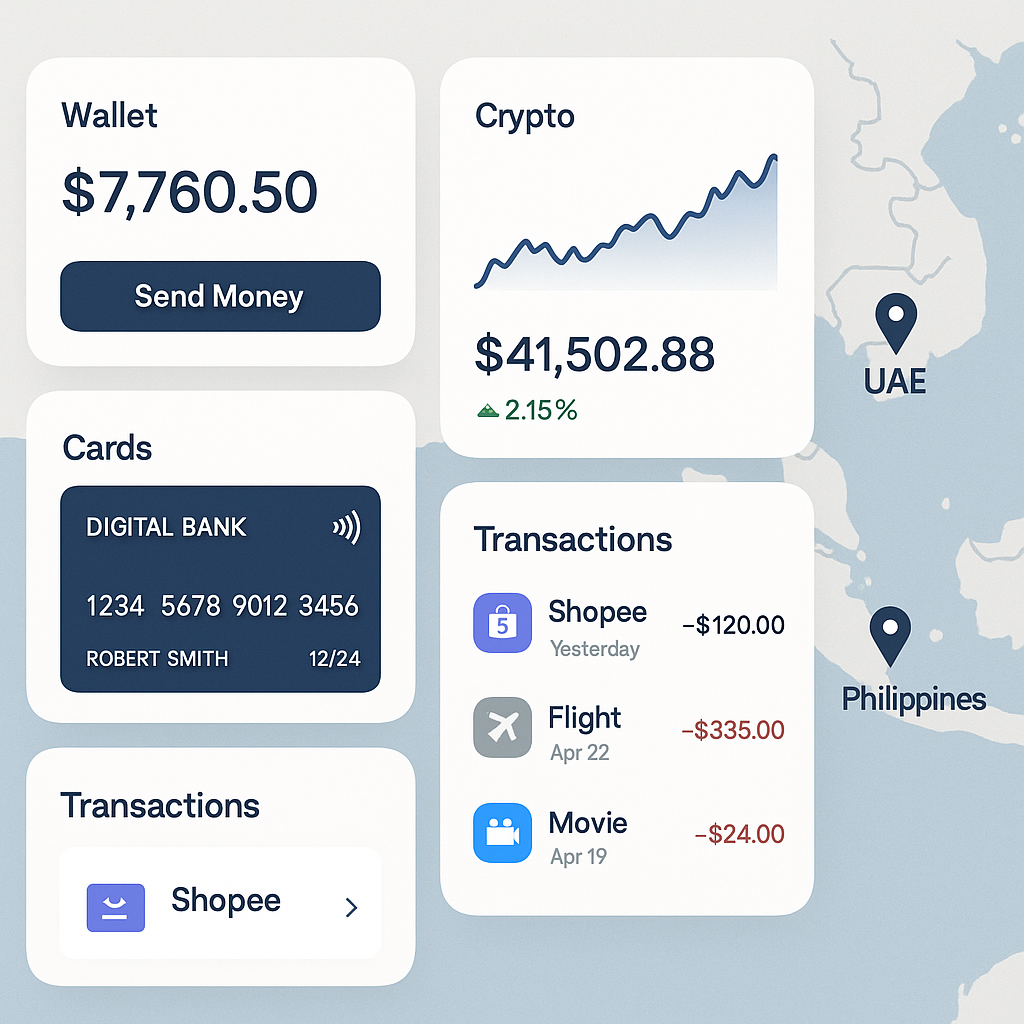

Step 3: Design a User-Friendly, Secure Crypto Trading UI

Your crypto interface should be as intuitive as stock trading apps like Robinhood. Focus on simplicity and trust.

Key features to include:

- Real-time pricing and charting

- One-tap buy/sell with fiat integration

- 2FA and biometric login

- Fee transparency

*Pro Tip:* Use Figma or Sketch to prototype before development. Validate with 10-15 real users for feedback.*

Step 4: Implement Backend Infrastructure & API Integration

Once your design is in place, it’s time to build the backend.

Checklist:

- Integrate with your chosen liquidity partner via REST or WebSocket APIs

- Set up a secure transaction service layer (Node.js, Python, or Go)

- Use custodial services like Fireblocks or BitGo

- Implement KYC/AML using vendors like SumSub or Trulioo

*Security Tip:* Conduct penetration testing using tools like OWASP ZAP or hire a certified auditor.*

Step 5: Conduct Regulatory and Security Audits

Before going live, you must undergo both internal and third-party audits.

Include:

- Code audits by a third party

- Penetration testing

- Regulatory audit (especially if acquiring or merging with a licensed entity)

Again, Robinhood’s entry into Indonesia was possible only because it acquired licensed companies with a clean track record.

Step 6: Launch Beta with Limited Users

Roll out your service gradually to mitigate risk and gather feedback.

Steps to follow:

- Invite early adopters (internal users, fintech enthusiasts, etc.)

- Monitor transactions, API latency, UX friction

- Iterate and fix issues quickly

*Keep regulators in the loop—provide sandbox testing performance if applicable.*

Step 7: Scale Operations & Market Strategically

Once stable, scale your service with a strong go-to-market strategy.

Best practices:

- Localize language and cultural UX

- Offer fiat-to-crypto onboarding via bank channels

- Use influencer fintech marketing and educational webinars

*Bonus Tip:* Partner with financial bloggers and podcasters for affiliate onboarding.*

Real-World Examples to Inspire You

Final Thoughts

Crypto trading in emerging markets is not just a tech challenge, but a regulatory and cultural one. By following these 7 steps, you can launch a compliant, user-centric platform that builds trust—and market share.

🚀 Ready to Build Your Crypto Trading App?

Hire vetted crypto developers or get design help on demand to speed up your MVP timeline.

💡 Want More Fintech + Crypto How-To Guides?

Subscribe to our newsletter and get weekly step-by-step tutorials for building the next big thing in Web3 and fintech. Click here to join free →