Exchange-Traded Funds (ETFs) are becoming the go-to investment tool for everyone from beginners to seasoned pros. But are you using them wisely?

Understanding the Rise of ETFs in 2026

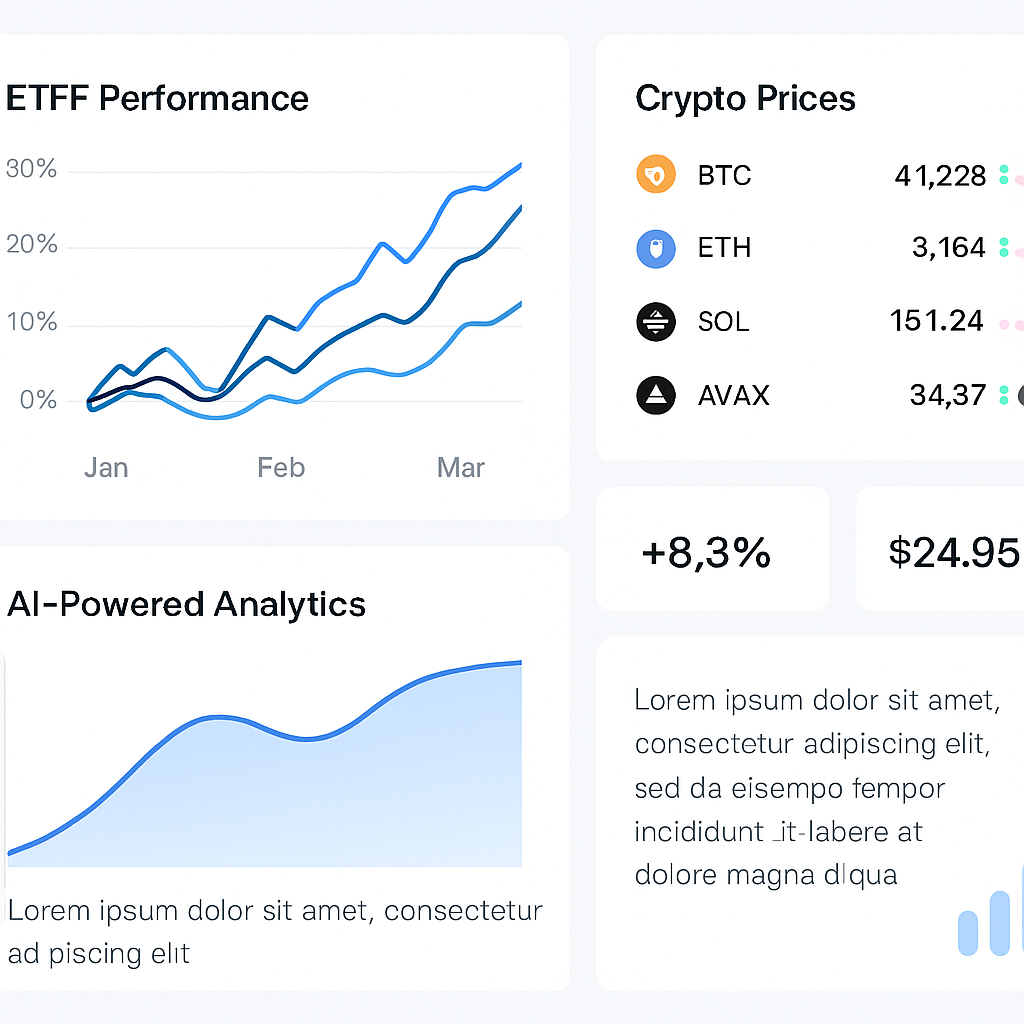

With the SEC accelerating the approval of crypto ETFs and more than 100 expected to launch in 2026, Exchange-Traded Funds are no longer just a traditional market play—they’re now central to crypto adoption, AI exposure, and even ESG strategies.

What makes ETFs so powerful? They combine the diversification of mutual funds with the trading flexibility of stocks. In essence, ETFs allow investors to own a basket of assets—like stocks, bonds, or cryptocurrencies—without having to buy each asset individually.

Types of ETFs You Should Know

- Index ETFs: Track major indexes like the S&P 500 (e.g., SPDR S&P 500 ETF – SPY).

- Sector ETFs: Focus on specific industries like tech, healthcare, or energy.

- Thematic ETFs: Cover emerging trends like AI, green energy, or blockchain.

- Bond ETFs: Provide exposure to government or corporate bonds.

- Crypto ETFs: New on the scene, offering access to digital assets like Bitcoin and Ethereum.

Why ETFs Matter Right Now

With inflation cooling and tech giants like Google investing $5 billion in Bitcoin-AI convergence, markets are signaling a risk-on environment. This makes broad-market and tech-focused ETFs particularly attractive for 2026.

What’s more, the average ETF expense ratio is under 0.25%, compared to around 1.5–2% for actively managed mutual funds. That can save investors thousands over the long term.

Build a Strong ETF Portfolio: Three Proven Strategies

1. The Core-Satellite Approach

Build your portfolio around a low-cost, diversified core ETF—like an S&P 500 fund—and add “satellite” ETFs with targeted themes or sectors.

Example:

- Core: Vanguard S&P 500 ETF (VOO)

- Satellites: ARK Innovation ETF (ARKK), Global X Robotics & AI ETF (BOTZ), Bitwise Bitcoin ETF (BITQ)

2. Dollar-Cost Averaging (DCA)

Invest a fixed amount regularly—say $500/month—into ETFs regardless of market conditions. This reduces the risk of mistiming the market.

Use automated platforms like Fidelity or Charles Schwab to set it and forget it.

3. Thematic Investing for 2026

With emerging trends in AI, crypto, and clean tech, thematic ETFs may offer explosive growth potential. But they also carry higher risk. Balance your exposure carefully.

Top picks:

Key Risk Factors to Watch

Liquidity: Not all ETFs are highly traded. Check the average daily volume and bid-ask spread.

Underlying Assets: Some thematic ETFs are concentrated in just a few stocks.

ETF Plumbing: As highlighted in recent reports, 85% of ETF assets may rely on the same clearing mechanisms—raising potential systemic risks.

Tax-Efficient Investing with ETFs

ETFs are more tax-efficient than mutual funds due to their in-kind redemption process. This means fewer capital gains distributions.

Use tax-advantaged accounts like Roth IRAs or HSAs to hold high-growth ETFs.

How to Get Started: Your Next Steps

- Open a brokerage account with Fidelity, Charles Schwab, or Vanguard.

- Decide on your risk tolerance: conservative, moderate, or aggressive.

- Choose a mix of core and satellite ETFs.

- Set up automatic contributions and rebalance annually.

Pro Tip: Use Portfolio Visualizer to back-test your ETF portfolio strategy.

CTA #1: Ready to build your ETF portfolio?

Open a Fidelity account today and start investing with $0 commission trades.

CTA #2: Learn More About Crypto ETFs

Check out this crypto market analysis to understand how Bitcoin ETFs could shape your portfolio.

Final Thoughts

Whether you’re investing for retirement, wealth creation, or just staying ahead of the curve, ETFs offer a flexible, low-cost, and transparent way to build a diversified portfolio.

In 2026, the smartest investors won’t just own a few stocks—they’ll own the future through ETFs.

0 Comments