Is Bitcoin’s next move a crash to $30K or a bounce to new highs? With volatility rising and conflicting predictions everywhere, mastering technical analysis is your secret weapon to profit in any market.

Understanding the Current Market: Fear, Volatility, and Opportunity

On January 26, 2026, two headlines rocked the crypto community. One forecasted a dramatic 72.86% Bitcoin crash to $30,000 (source), while another confirmed that 93 of the top 100 cryptocurrencies were in the red (source). Headlines like these create panic—but for savvy traders, volatility equals opportunity.

In this guide, you’ll learn how to:

- Read crypto candlestick charts

- Use technical indicators to spot entry and exit points

- Build a trading strategy that adapts to market conditions

What Are Candlestick Charts?

Candlesticks are the most common way to visualize price movements in crypto markets. Each candle shows four key data points:

- Open: The price when the candle started

- Close: The price when the candle ended

- High: The highest price during the time period

- Low: The lowest price during the time period

A green (or white) candle means the price went up, while a red (or black) candle means it went down. Learning to read these quickly helps you spot momentum shifts.

How to Spot a Trend

Before you place a trade, identify the trend. Is the market going up, down, or sideways? Here’s how to tell:

- Higher highs and higher lows = Uptrend

- Lower highs and lower lows = Downtrend

- Flat highs and lows = Sideways market (consolidation)

Use larger timeframes (like the 1-day or 1-week chart) for trend direction and smaller timeframes (like 15-minute or 1-hour) for entries.

Top 3 Indicators EVERY Crypto Trader Should Know

1. Moving Averages (MA)

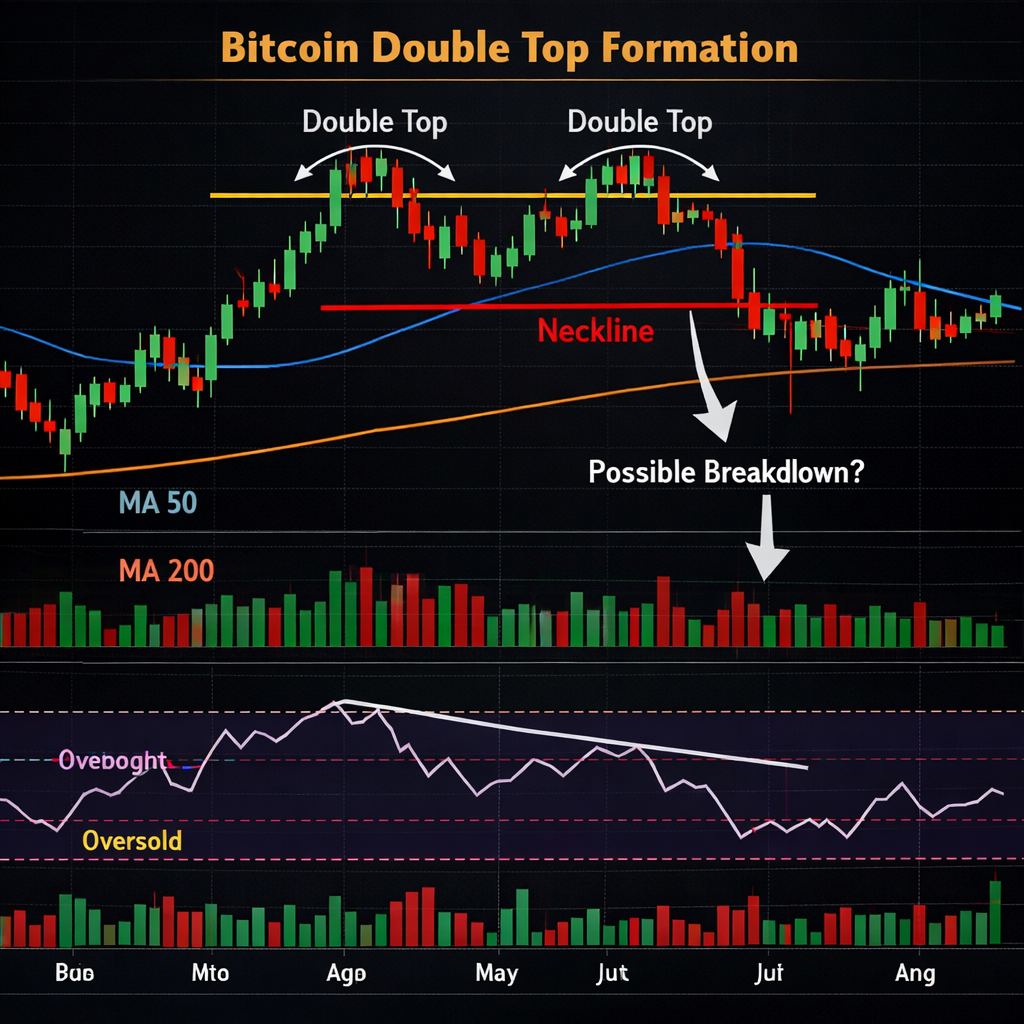

These smooth out price action. The 50-day and 200-day Moving Averages are commonly used. If the 50-day crosses above the 200-day, it’s a bullish signal—known as a Golden Cross. The opposite is a Death Cross.

2. Relative Strength Index (RSI)

RSI measures whether a coin is overbought (>70) or oversold (<30). Use RSI to time entries. For example, if XRP drops to RSI 30 in an uptrend, it could be a great buy opportunity (source).

3. Volume

Volume confirms price moves. A breakout is more reliable if it’s backed by high volume. Watch the volume bars below candlestick charts to confirm strength.

Reading Chart Patterns: Your Trading Edge

These classic patterns give you high-probability setups:

- Head & Shoulders: Signals a reversal

- Double Top / Bottom: Indicates exhaustion

- Triangles (ascending/descending/symmetric): Signal breakout is coming

Example: When Bitcoin formed a double top in 2021, it crashed. Now analysts are warning it’s repeating that pattern (source).

Strategy: The 3-Step Entry Plan

Follow this simple system for entering trades:

- Identify the trend using MA and price structure

- Find entry zones using RSI, support/resistance, and Fibonacci

- Confirm with volume before placing a trade

Pro Tip: Use TradingView (free) to chart crypto assets and apply indicators.

Risk Management: Protect Your Capital

Never trade without a plan. Here’s how to manage risk:

- Risk max 1–2% of your portfolio per trade

- Use stop-losses below key levels

- Take profits at pre-defined targets

Example: If BTC trades near $42K, and you expect a bounce to $47K, place your stop-loss at $40K and take profit at $47K. That’s a 2:1 reward-to-risk ratio.

Adapt to Market Sentiment

Don’t just trade the charts—read the mood. Tools like the Crypto Fear & Greed Index can help. If fear is high, prices may be near a bottom. If greed dominates, a correction could be near.

Real-World Events That Affect Technicals

Even the best chart setups can be disrupted by news. Keep an eye on:

- Regulatory shifts (e.g., CZ’s pardon)

- Stablecoin developments (e.g., USD1 vs Paypal)

- Macroeconomic data (interest rates, CPI reports, etc.)

Breakouts can fail when breaking news hits the market. Stay alert.

Build Your Trading Routine

Success in crypto trading comes from consistency. Follow this simple daily routine:

- Scan the market at the same time daily

- Check your watchlist for setups

- Log your trades in a journal

- Review wins/losses weekly

Want a proven crypto trading journal template? Download this free tracker you can customize today.

Final Thoughts: Trade With Confidence, Not Emotion

Markets are volatile. Predictions will always differ. But with strong technical analysis skills, you can make **informed decisions** regardless of whether BTC crashes or skyrockets.

Start simple. Focus on learning one or two indicators. Use demo accounts. And most importantly—master your mindset.

Ready to level up your skills? Join our free Telegram group for live chart breakdowns, trade ideas, and real-time coaching. Click here to join.

Trade smart. Stay sharp. And always manage your risk.

0 Comments