With over 100 new crypto ETFs set to launch in 2026 and recent market turbulence, investors need a clear strategy to stay ahead in a volatile environment.

Understanding the Current Crypto Landscape

The cryptocurrency market has seen a 1.5% pullback as of December 18, 2025, pushing the total market cap down to $3.01 trillion. According to CryptoNews, 95 of the top 100 cryptocurrencies declined in value within 24 hours, indicating widespread market uncertainty. Meanwhile, total trading volume remains relatively high at $129 billion.

This volatility comes amid several structural and psychological triggers in the market:

- Regulatory changes accelerating ETF approvals

- Technical misunderstandings, such as misinterpreted whale activity

- Concerns about security vulnerabilities in private key storage

- Project roadmap shifts, like Cardano’s commercial pivot

Crypto ETFs: The Game Changer for 2026

In a landmark development, the SEC approved generic listing standards for crypto ETPs in September 2025. This decision slashed the launch timeline to just 75 days, paving the way for over 100 new crypto ETFs in 2026. While ETFs are typically seen as a stabilizing force, experts are warning of a potential “single point of failure” that could freeze up to 85% of global crypto assets due to shared underlying infrastructure.

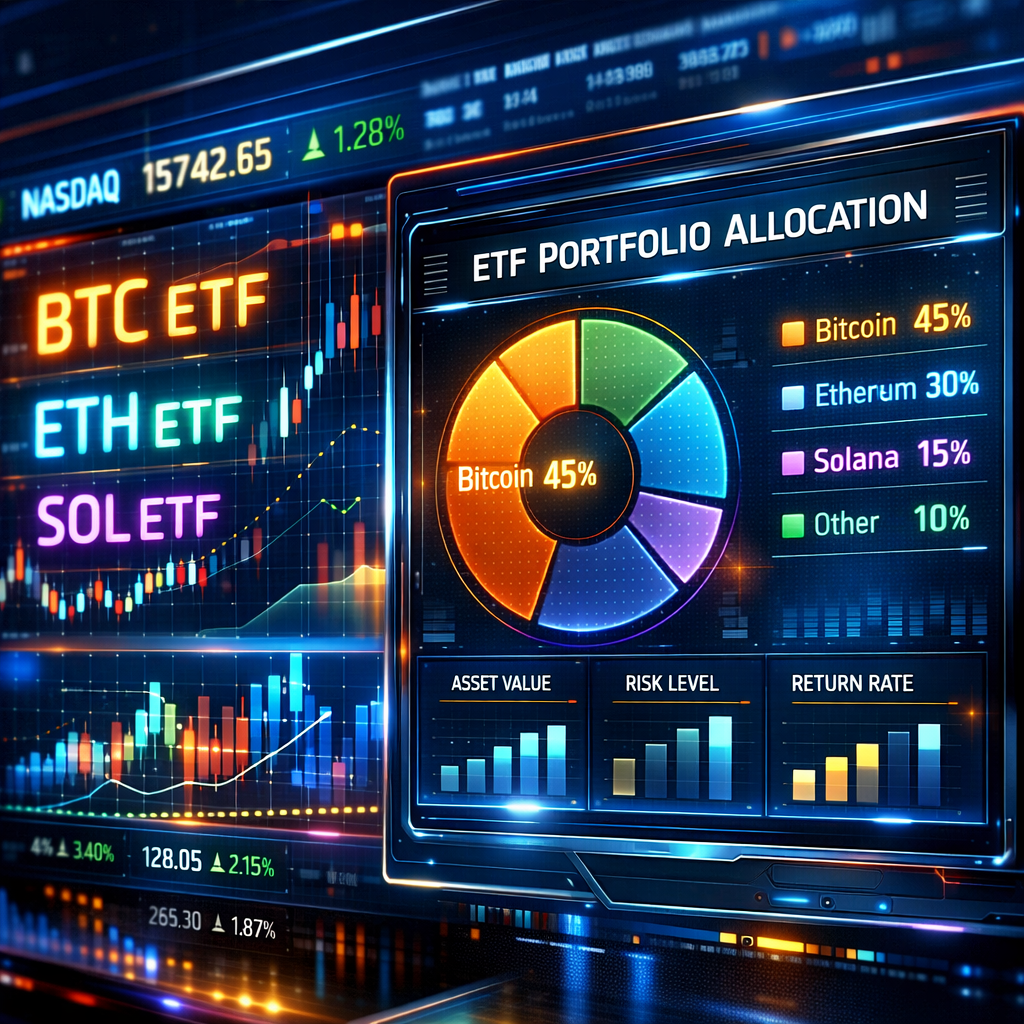

Types of Crypto ETFs to Watch

- Spot Crypto ETFs: Direct exposure to digital assets like Bitcoin or Ethereum.

- Futures-Based ETFs: Based on CME or other derivatives contracts.

- Blockchain ETFs: Invest in companies leveraging blockchain technology.

Actionable Tip: Look for ETFs with diversified underlying assets and unique custodial infrastructure to avoid systemic risk.

How to Invest in Crypto ETFs Safely

Crypto ETFs offer an accessible on-ramp to digital assets without requiring private key management. But not all ETFs are created equal. Here’s how to choose wisely:

1. Examine the Underlying Custodian

Avoid ETFs reliant on a single custodial infrastructure. Instead, prioritize funds that use multi-signature wallets or third-party custodians like Coinbase Custody or Fireblocks.

2. Understand the Fee Structure

Look for ETFs with expense ratios under 1%. High fees erode gains, especially in volatile markets.

3. Track Liquidity and AUM

Higher liquidity and assets under management (AUM) often indicate safer and more established ETFs. Anything under $50 million AUM may carry higher volatility and slippage risks.

4. Diversify Across ETFs

Don’t put all your eggs in one basket. Spread investments across spot, futures, and blockchain-focused ETFs.

Explore vetted crypto ETFs on ETF.com

Why the Market Misreads Signals: A Case Study

Earlier this week, a $5 billion Bitcoin whale buy signal went viral. The market interpreted this as bullish. However, it was later revealed as a statistical artifact caused by institutional wallet reshuffling. This miscommunication briefly inflated prices before triggering a sharp correction.

Lesson: Always verify on-chain data using sources like Glassnode or WhaleMap before making trades based on social media hype.

Private Key Risks: The Billion-Dollar Flaw

Private keys have long been the Achilles’ heel of crypto security. According to CryptoSlate, billions have been lost due to lost, stolen, or compromised private keys. This design flaw becomes even more dangerous as mainstream ETF investors enter the space in 2026.

Alternatives Emerging

- Multi-signature wallets (e.g., Gnosis Safe)

- Social recovery wallets (e.g., Argent)

- Biometric authentication and hardware wallets

Pro Tip: If you’re self-custodying assets, pair a hardware wallet with a secure password manager and enable two-factor authentication.

📈 Want to optimize your crypto ETF portfolio for 2026?

Use Morningstar’s ETF screener to find low-cost, high-performing funds that suit your goals.

Personal Finance Tips for Investing in Crypto ETFs

Whether you’re a seasoned investor or new to the space, here are smart personal finance strategies to manage risk and maximize returns in crypto ETFs:

1. Follow the 5% Rule

Don’t allocate more than 5% of your total portfolio to crypto assets. This keeps your exposure in check while allowing for outsized gains.

2. Use Dollar-Cost Averaging (DCA)

Instead of lump-sum investing, spread purchases over time. This mitigates the impact of short-term volatility.

3. Stay Liquid

Ensure at least 6-12 months of expenses are held in a high-yield savings account or treasury ETF before investing in volatile assets like crypto.

4. Review Your Portfolio Quarterly

Rebalance based on performance. If your crypto ETF allocation balloons to more than 10%, consider trimming positions to lock in profits.

Use Personal Capital’s free financial dashboard to track your net worth and rebalance intelligently.

📢 Get Ahead of ETF Trends

Subscribe to our newsletter for weekly insights on crypto ETFs, market volatility, and personal finance strategies.

Conclusion: Be Proactive, Not Reactive

The rapidly evolving crypto ETF landscape will redefine how investors engage with digital assets. But with opportunity comes risk. By understanding the structure behind these products, diversifying across ETF types, and maintaining personal finance discipline, you can navigate volatility and position your portfolio for long-term success.

Final Thought: In crypto, the best investors are not those who predict the next moonshot, but those who manage risk, stay informed, and think long-term.

0 Comments